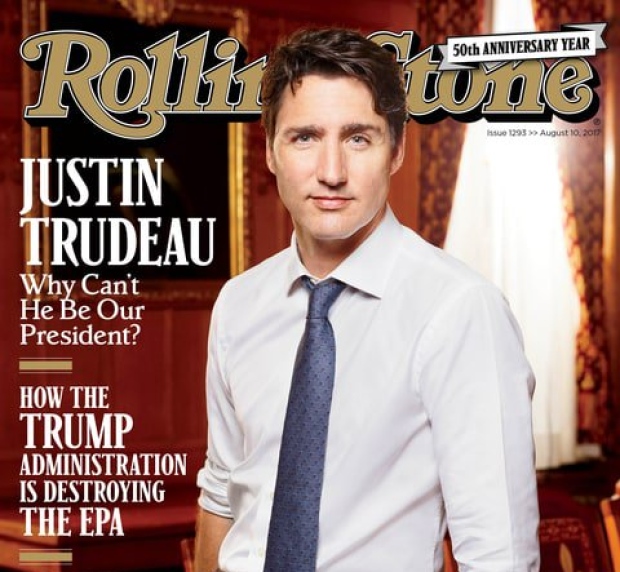

Sometime in August, or maybe September, or, who knows, maybe even later (but definitely for sure before the next federal election), Canadians will be able to legally buy cannabis for recreational use.

Everything is in hand, we are told.

Mother Government will be the new pot dealer for most Canadians. Ontario and Quebec have already announced that their booze monopolies will handle cannabis in the same cartel fashion– dictating what we can buy, how we can buy it, and what price we will have the privilege of paying.

It sounds as Canadian as maple syrup (which is also sold by provincially managed price-fixing cartels known as marketing boards); Canadians are used to being told by government how and when and where we can spend our money. A lot of us actually think it’s a good thing. It makes us more compassionate, and un-American, or something.

- How the provinces are planning for pot legalization

- Health Canada proposes strict limits on marijuana packaging, production

But here’s the thing: it’s not going to work. There’s no other sensible conclusion. Government marketing of recreational marijuana is going to be the business equivalent of a dog in a bowling alley.

Think about it: Governments actually intend to displace a thriving, entrenched, efficient, long-standing, highly connected, multi-billion-collar black market — one with an established, often loyal customer base. To do so, they will create Soviet-style, command-economy, top-heavy marketing contraptions, staffed up with bureaucracies, employing civil servants who enjoy good (read: expensive) pay, benefits and pensions. Public sector unions are delighted.

These new government departments will immediately proceed to fix the price of marijuana at a significantly higher rate than Canadians now pay ($10 a gram is the most widely floated debut price for officially sold pot. Canadians now pay an average of $7, according to Statistics Canada). A ten per cent excise tax will be embedded in the price, and then of course HST will have to be added. And governments will decide what quality of cannabis is appropriate for recreational consumption.

Money from marijuana legalization is something many provinces haven’t had to budget for before, but with the extra cash from cannabis also comes some extra costs. CBC News takes a look at how different provinces are rolling out their fiscal plans, and their expectations of pot revenue and how they plan to spend it. 2:45

Canadians will go along with all this, according to government logic, because they are told to. It will, after all, be a summary offence to buy from anyone other than your friendly government pot dealer. Besides, the booze monopolies are wondrously lucrative, aren’t they? The Liquor Control Board of Ontario (LCBO) successfully dictates alcohol prices, and which wines and spirits Ontarians may purchase, and has been doing it for nearly a hundred years, vacuuming up billions in tax revenue for the province in the process.

How is cannabis any different? Well, actually, the question should be: how is cannabis at all similar?

Most good wine and liquor comes from foreign wineries or distilleries; it certainly can’t be produced just anywhere. Cannabis can, and is.

Regulating tobacco

In fact, a much better comparison for cannabis is tobacco. Tobacco is a plant, too. It’s produced locally to be dried and smoked, it’s heavily taxed, and buying it on the black market, untaxed, is an offence, just as contraband marijuana will be under the new Canadian regime.

So let’s take a look at how well governments in Canada have done with regulating and taxing tobacco, shall we?

Quick question: How much of the tobacco consumed in Canada every day is illicit?

The answer is 30 to 50 per cent, depending on the province and location, meaning millions of Canadians ignore the law and simply seek the lowest price.

The vast majority of contraband tobacco goes through Indigenous reserves, like Akwesasne, near Cornwall, Ont., or Kahnawake, south of Montreal, smuggled in or manufactured there before being exported, often to organized criminals, notably outlaw motorcycle gangs, according to an authoritative study by the Macdonald Laurier Institute.

Enforcement is difficult because Canadian police tend to allow reserves to police themselves. And of course Indigenous people on reserves are treated as sovereign and do not pay taxes. I’ve heard band chiefs refer to tobacco taxation as a white man’s problem; it isn’t their job to collect it or enforce it.

Stiff taxation of newly legalized cannabis will also play into the black market’s hands, if tobacco is any indication. (Toby Melville/REUTERS)

For all that, First Nations entrepreneurs make massive profits selling tobacco to Canadians. Does anyone seriously think they’re going to leave the marketing and sales of newly legal marijuana to provincial governments?

“Our information is that First Nations businesses are going to shift production from tobacco to marijuana,” says Michael Watts, a lawyer at Osler, Hoskin & Harcourt, a huge Toronto-based law firm increasingly specialized in cannabis-related law. (Osler also happens to represent Imperial Tobacco). “They have already applied for growing licenses, and clearly, the federal government is not going to be able to deny them licenses.”

Stiff taxation of newly legalized cannabis will also play into the black market’s hands, if tobacco is any indication. Governments discovered long ago that there is a direct correlation: whenever some province decided to impose heavier sin taxes on smoking, sales of contraband cigarettes spiked immediately, robbing governments of whatever extra revenue they’d hoped for.

Privacy concerns

Then there’s the comfort and privacy issue. Millions of Canadians are already accustomed to buying cannabis from dealers, despite the fact that it is at the moment a federal crime. Quality has improved drastically over the years, the chances of being caught are minimal, really, and with a dealer, your name stays off the government’s radar. Dealers also don’t collect tax.

So why would anyone want to turn around and start buying it directly from an official monopoly, exposing your consumption and name to government, and paying significantly more for the product in the process?

Given a chance to bet on the agility, efficiency and adaptability of the black market, versus a sheltered monopoly like Ontario’s LCBO, I know where my money would go.

No wonder the investment analysts at Grizzle, a website that assesses risk in so-called “new money” ventures, are issuing warnings about buying cannabis-related securities.

Ultimately, legalization will be good for Canadians. No more stupid criminalization of a relatively harmless (compared to booze) pastime. It might even be amusing to watch government try to muscle in on the market, rather than just letting businesses compete and taxing the sales, the way American states do.

We’ll all pay, somehow, for the mess that’s coming. It doesn’t need to happen. But it will, because Canada.

This column is part of CBC’s Opinion section. For more information about this section, please read this editor’s blog and our FAQ.