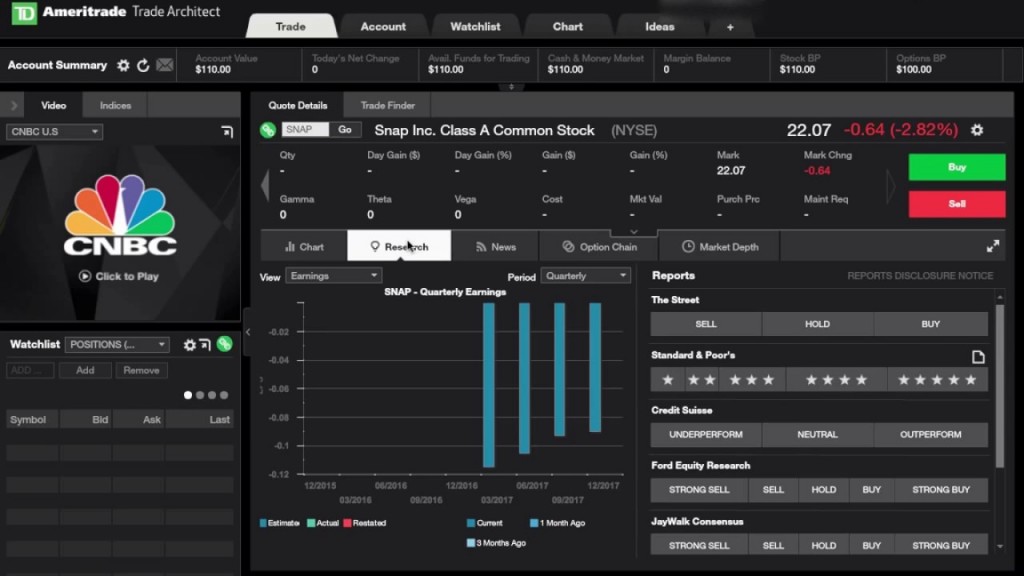

Investors are decamping Canadian banks ahead of earnings season, with six straight weeks of outflows from the largest exchange-traded fund tracking the industry.

The BMO Equal Weight Banks Index ETF saw a record $263 million (US$204 million) leave the fund between April 2 and May 11, according to data compiled by Bloomberg.

But the fact that the iShares S&P/TSX Capped Financials Index ETF and the Horizons S&P/TSX Capped Financials Index ETF also saw similar, albeit smaller outflows, indicates a bigger trend in investor attitudes toward the sector.

“That suggests to me that there is a kind of souring on financials among Canadian investors,” said Daniel Straus, vice president of ETFs and financial products research at National Bank of Canada.

Investors piled into Canadian banks through 2016 and 2017 in anticipation of rising interest rates, which can boost margins on loans.

“What happened in 2016 and 2017 is the financials did so well that the trade became pretty crowded,” Straus said. “I think that at the start of 2018, with volatility kicking in, there could be reasons to suggest that perhaps that trend is over-extended and a lot of those movements are priced in.”

Canada’s housing market has also seen an abrupt cooling since then, which may weigh on mortgage growth. Home sales fell to the lowest in more than five years in April amid tougher mortgage qualification rules.

Canadian bank stocks are little changed this year according to the S&P/TSX Composite Commercial Banks index versus a 2.8 per cent gain for KBW Bank Index of U.S. banks.

Earnings season for the banks’ fiscal second quarter kicks off Wednesday with Canadian Imperial Bank of Commerce, followed by Royal Bank of Canada and Toronto-Dominion Bank on Thursday. Analysts are forecasting earnings per share growth of seven to 10 per cent for the group.

Bloomberg.com